The backdoor roth ira conversion is an indirect way to contribute to a roth ira when you are not eligible to contribute directly due to high income.

Backdoor roth ira conversion deadline 2019.

This can cause some confusion since you generally have until april 15 of the following year to add.

Last week we talked about this year s july 15 deadline for 2019 ira contributions.

Roth ira income limits if your annual income is low enough you may.

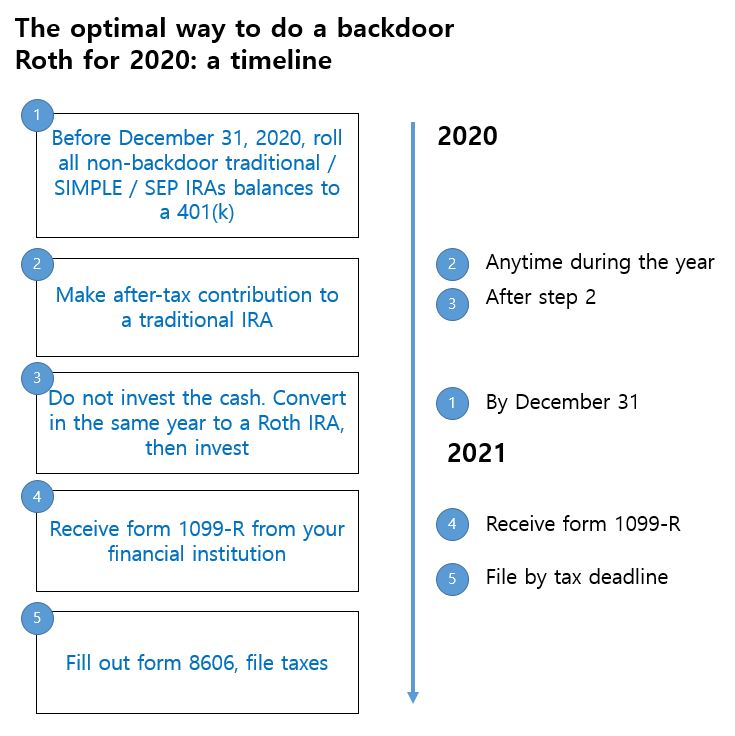

Steps in converting to a roth ira.

31 of that year.

December 31 2019 for the 2019 tax year.

Here s why you may want to reconsider doing that backdoor roth ira conversion published.

That is if you haven t made your 2019 ira contribution and you don t qualify for a roth contribution due to income limits consider doing a backdoor roth for 2019 and while you.

This threw me off as i thought the conversion would be under roth 2018 but the conversion did take place in 2019 so it ended up under roth 2019.

July 15 is also an important date for backdoor roth conversions for people who don t qualify for roth contributions.

The conversion is reported on form 8606 pdf nondeductible iras.

See publication 590 a contributions to individual retirement arrangements iras for more information.

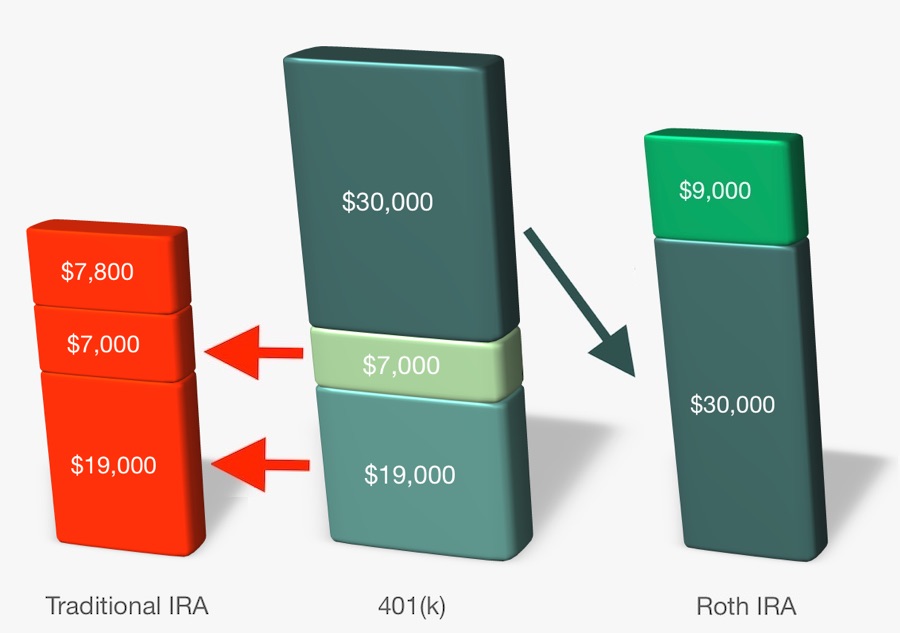

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Funding your backdoor roth ira before the federal tax deadline april 15 2020 lets you enjoy tax savings for 2019 as well.

A regular backdoor roth ira conversion.

Remember to be able to fully contribute to a roth ira you have to meet the following income limits as of 2019.

A backdoor roth ira can make sense in the same scenarios any roth ira conversion makes sense.

I was worried that when i contibute 6000 to 2019 tira then convert to roth it would hard stop me for going over the 2019 roth contribution limit.

The deadline for executing a roth ira conversion for a given tax year is dec.

April 23 2019 at 10 16 a m.