Converting either traditional ira or 401 k dollars to a roth ira.

Back door roth 2018 fidelity.

For more detail see converting your traditional ira to a roth ira.

Fidelity cannot guarantee that the information herein is accurate complete or timely.

For 2018 those with magi between 120 000 and 135 000 are eligible to make partial contributions.

2018 you are still fine.

Just funded my traditional ira went to convert and got this message.

You have until april 15 2019 to contribute to a roth ira for 2018.

But i learned fidelity has now worked it out so that after tax contributions will be automatically scraped every month and put into a roth ira.

The reason to do a backdoor roth ira as opposed to just funding it through the front door is because there are income limitations for contributing.

You had to really know what you are doing and then make periodic phone calls to to a conversion.

Core now shows small gain after money went to roth what to do.

Using the mega backdoor roth method was cumbersome previously.

So this brings the total tax advantaged contribution amount possible to 57k pre post tax via 401k 6k via traditional ira to roth backdoor 3550 hsa.

It can t grow that much.

Tax laws and regulations are complex and subject to change which can materially impact investment results.

If you re single and have an adjusted gross income agi between 124k 139k you can make a partial contribution.

Use fidelity s ira contribution calculator to determine your partial contribution amount.

I think it s just a label and not a distinctly treated entity since egtrra in 2001.

In this instance 12 31 2018.

On top of this if employers allow you can do the mega backdoor roth which is what this post is about.

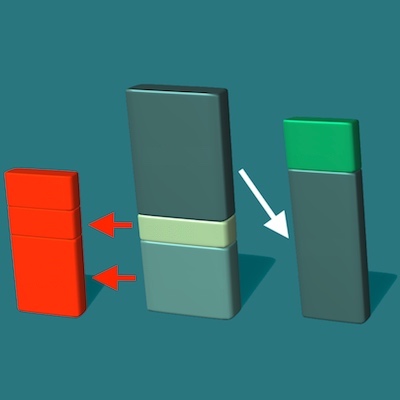

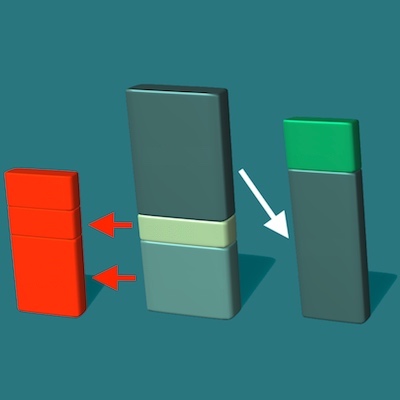

This is called backdoor roth and can be done by anyone irrespective of employer.

In 2020 the direct contributions to a roth are as followed.

For 2018 you have to make less than 189 000 if you are married filing jointly to contribute the full 5 500.

From 189 000 to 198 999 the amount begins to be phased.

This strategy is sometimes called a back door roth contribution.

I think you should be able to use the rollover ira for contributions.

How to do backdoor roth on fidelity.

You can convert the 37 cents pretax balance and pay the rounded to 0 income tax if you want or wait until the next backdoor.

The backdoor roth conversion is a way to be able to use a roth ira if you make too much money.

2 the news for high income taxpayers is that they can still benefit from a roth ira if they re willing to take 1 of 2 indirect routes to get there.

For 2017 those with magi between 118 000 and 133 000 are eligible to make partial contributions.

Why do a backdoor roth ira.